2016-2023 | BoschCase Studies:

Some Wins Challenging Losses; A Journey with People, Process & Technologies

sweetworxx, a Bosch VentureBosch Car Service: Connected MobilityL.OS; Logistic Operating System, Bosch + awssweetworxx, a Bosch Venture

-

sweetworxx

Bosch Group | Bosch Automotive | Digital Car Care & Mobility Platform Pilot

2016Venture Context & Go-To-Market Objective

sweetworxx was launched as a digital, mobile-first concierge car care platform to modernize automotive service delivery and expand Bosch’s footprint in consumer-facing mobility services. Designed as a controlled pilot in Orange County, California, the venture connected drivers, repair shops, carriers, and parts suppliers through a unified platform offering pickup and drop-off services, intelligent service matching & tracking behavior, geo-fenced logistics coordination, and time-based orchestration.

The objective was to one day have mass-market digital network scale for future Bosch Car Service. The initial pilot was to support proof of systems viability—demonstrating how connected vehicle data, diagnostics, logistics, and consumer-grade CX could converge into a future-ready Bosch Car Service network. We wanted to provide convenience and access to our consumers so they could enjoy their daily lifestyles as we were to serve as their companion for auto repair and additional services.

Ann was brought in as an industry specialist and market leader to accelerate commercialization—aligning fleet operations, product marketing, and GTM strategy with engineering and platform teams. Her mandate centered on translating complex technology and industry buyer behavior into market-ready execution, driving bookings, and stress-testing the operating model under real demand.

-

Systems Thinking & Platform Integration

The operating model was built around end-to-end systems integration, designed to move beyond transactional car care toward a data-driven mobility platform:

Translating sensor and diagnostics data into actionable insights and intelligent decision-making

Establishing cloud-based diagnostics architecture to support future vertical and enterprise integrations

Governing partner data integration to enable future B2B mobility clients within a shared network

Enabling a B2B mobility platform that increased technology adoption and unlocked new market share for service owners

Implementing data-to-decision execution models to support Bosch’s hierarchical and global decision structures

Strengthening nationwide parts and logistics distribution management to reduce friction and improve service reliability.

Hierarchy over-reliance on external vendors and consulting partners vs. investing in specialist hires. Later reviewed as consulting partners who struggled to understand the industry initiative more concerned with billables; attached to intentional failure.

-

Primary KPIs:

High-fidelity connected vehicles, diagnostics accuracy, and data intelligence maturity.Execution Constraints & Market Realities

While early demand validated the concept, execution revealed structural constraints common to enterprise-led innovation pilots. The accelerated launch timeline limited the development of robust financial models, KPI frameworks, and forecasting mechanisms needed to support revenue velocity and scale.

The venture faced challenges hiring hands-on engineers, dev ops and financial logistics specialists with deep experience in API integration, data orchestration, and real-time mobility systems within constrained pay bands. Budget allocation—sourced from adjacent innovation funds—restricted flexibility to invest in critical technical talent and platform hardening.

Strategic dependency on overseas approvals further slowed iteration, as global stakeholders were removed from U.S. market dynamics, consumer behavior, and unit economics. As Bosch reprioritized away from disruptive car care with north star focus towards electrification, traditional sales, and AI-enabled logistics platforms, funding was held as we were in discussions for MA/overseas relocation.

-

Capitol & Initiative led by Bosch Group, Bosch Automotive:

Global Chair of Management Bosch Group, CFO & CAO responsible, now President CEO Bosch Global Service, Board Member of Directors - Maximiliane Straub

Co-Founder Robert Bosch GmbH, Digital Repair Shop and Business Model Innovation - Levent Hikmet Surer

Senior Vice President Workshop Concepts, Business Unit Lead Service, Robert Bosch GmbH, now Executive VP, Board Member -Heike Nieuhaus

Vice President Finance & Controlling, North America, Bosch USA, now Vice President Finance & IT Services - Uwe Hirsch

Director Business Model Innovation Robert Bosch GmbH, now Vice PresidentBusiness and Digital Strategy Lead - Dr. Carl Christian Koffman

UX Evangelist, Director Software Engineering Front End Bosch USA, now Senior Manager Engineering Operations, Hyperscaler - Carlos Orozco

Global User Research and Testing Specialist, Robert Bosch GmbH- Stefan Riedel

General Manager/ CEO, sweetworxx, Global Director of Technical Services, Bosch USA, Automotive Aftermarket North America, OCBJ stated “Innovator of the Year”. Previous Head of Robert Bosch South America, Brazil Workshop Concept Services; Bosch Car Service - Daniel Angelo

Senior Global Director, Ex-Bosch Director Global Key Accounts Off-Highway & sweetworxx- Ralph Pompea

-

Ann’s Reflection:

Platform businesses require systems-first thinking—logistics, diagnostics, data, and CX must be architected together, not sequentially or after a technology breaks..

Speed without governance creates fragility: revenue traction must be matched with financial rigor, KPI ownership, and decision clarity. Always difficult in startup mode.

Technical builders matter more than advisors: scalable platforms depend on engineers and data-driven operators, not external consulting alone.

Global innovation governance must reflect local realities: distance from market weakens viability assessments and execution agility.

Connected vehicle data is a strategic asset—when translated into intelligence, it enables stronger logistics, diagnostics, and enterprise decision-making. Difficult to not get stuck in the weeds when decisions need to be made vs. lost time on research/ analyzing data.

Reflection:

sweetworxx validated the opportunity—and complexity—of AI-enabled, data-driven mobility platforms inside large enterprises. While the pilot concluded due to strategic reprioritization, it delivered enduring lessons on systems integration, platform economics, and execution discipline that continue to inform how connected mobility, logistics intelligence, and enterprise innovation should be built to scale.

Research Considerations & Media Center

The gap, visibility with enablement; measuring brand legitimacy with failure:

Growth & Reconciliation: Overfitting vs. Adaptation; how to get growing

Market opportunity, improving operations at scale through branding & partnerships.

Read onward with Harvard Business Review; other successful players making moves and coaching along the way.

Bosch Car Service + shop-ware, a Bosch Automotive Aftermarket Venture

-

2019

Case Overview

Bosch Car Service launched a national pilot to transition its enterprise automotive service network toward a centralized shop management software platform. The vision was to modernize independent repair operations through a unified digital stack—enabling data-driven diagnostics, greener service models, and tighter integration across parts, logistics, and connected vehicle systems.

Following initial go-to-market execution, adoption lagged expectations for a variety of reasons. Market share was primarily automotive enterprise owners servicing European vehicles, parts distribution, ordering, and other variety of systems were already integrated into traditional hardware systems. Change was difficult, technical upskill required, switching costs was difficult and traditional legacy change in business ownership were all in consideration. Owners were not using universal systems, instead multiple platforms and SMS integrators to run successful companies. The question remained ‘why Shop-Ware’.

Conversion rates were inconsistent, drop rates high after demo, early adopters struggled operationally, and field feedback signaled misalignment between product readiness, market needs, and operating capacity. Bosch was aware but wanted to go to market.

In response, Bosch brought Ann in as the National Sales Software Adoption and Implementation Leader to assess market viability, identify constraints, and stabilize execution.

-

Operating Model & Execution Reality

The operating model was structured as a startup-style venture, digital mindset, operating within a traditional, distributor-led parts sales environment. While innovation goals were ambitious, execution was constrained by product challenges, transfer losses, legacy sales motions, external partner hardware dependencies, and limited technical field capacity.

Key characteristics and challenges included:

Role & Mandate: Ann was brought in post-launch to evaluate why adoption was stalling, assess software-product fit, and surface risks impacting conversion and customer viability.

Product Readiness Gaps: The software platform lacked sufficient functionality and reliability for national-scale deployment; workarounds addressed symptoms but not core deficiencies. Post onboarding loss could not be recovered.

Partner & Co-Development Pitfalls: Misalignment with venture and software partners slowed iteration cycles and limited responsiveness to field realities.

Field Enablement Constraints: Insufficient numbers of technically fluent field specialists capable of training, onboarding, and supporting shop owners through complex workflow transitions.

Organizational Tension: A national sales team, operating across multiple regions, was pressured to meet KPIs tied to conversions, while converted shops struggled to run their businesses effectively with limited product offers while they had more robust offerings and interconnected repair shop logistics with multiple systems.

Structural Friction: External staff reported into distributors and partners, creating fragmented accountability and strained multi-level sales and relationship channels.

Governance Distance: Headquarters operations were centralized in Chicago, while key product were in San Francisco and financial and strategic stakeholders abroad —many overseas—were removed from real-time U.S. market conditions for some market shift decisions.

Despite extensive travel, stakeholder presentations, and risk assessments, structural & capability constraints limited the ability to recalibrate the product, build, and operating model fast enough to support sustainable adoption.

-

Primary KPIs & Success Measures

The pilot focused on metrics designed to signal future platform viability rather than short-term revenue alone:

Software conversion and active usage rates

Field onboarding velocity and training completion

Operational stability of converted shops

Customer retention and service throughput

Platform reliability and workflow efficiency

North Star KPIs:

High-fidelity connected vehicle data.

Diagnostics, parts distribution tracking, accuracy and intelligence.

Data-driven decision support across service operations.

These KPIs revealed a growing disconnect between conversion targets and operational health.

-

Innovation velocity must be matched with execution readiness; software-led transformations are difficult, they can fail easily when product maturity, lack of updated features, competitive product, training capacity, and market realities are misaligned.

Forcing adoption to meet KPIs can erode trust and strain channel relationships when customers are not operationally equipped to succeed.

Startup operating models cannot scale within legacy sales environments without clear governance, technical ownership, and accountability alignment.

Field enablement is a strategic investment—not a downstream function—especially in complex software transitions.

Market proximity matters: decision-makers removed from customer realities delay necessary course correction.

Ultimately, the pilot highlighted that systems thinking, technical fluency, and economic viability must converge before scale.

Ann’s Reflection:

Commercialization, Governance, and CX; Failing Forward

Why Marginal Revenue Doesn’t Always Equal Marginal Cost

Enterprise software conversions fail without proper people, process, and product/technology readiness; initial GTM efforts should ensure proper systems, data integrity, and implementation discipline.

Transformation efforts require “shared values and team collaboration”; one team one dream mentality, clear platform governance and accountable leadership ownership.

Misaligned incentives and immature data models amplify execution risk at scale.

Sustainable change depends on regional adoption factors, de-risking early, aligning stakeholders, and establishing operational clarity before growth or continued degradation of channels.

Global mandates require regional execution awareness, where geopolitical context,stakeholder adoption, and accountabilitymaterially impact outcomes.

Success in global programs depends on sensitivity and agility to regional geopolitics, local stakeholders, and execution realities.

Effective leaders understand their strengths and limits. Leadership demands self- awareness and judgement, know when to rely on others to elevate the outcome, step back to learn when required, and intentionally create space for others to lead—setting ego aside in favor of disciplined listening, clarity, and agility; for the company, for all stakeholders involved, for preservation of your clients.

When going to market, companies and stakeholders must focus on long-term economic value—not just cost drivers—because what’s at stake extends beyond capital to the people leading, building, and carrying the outcome; agility, continuous learning, and knowing when to seek counsel are essential. Ethics and humility go a long way; in a company culture of intelligence, and for the relationships that compound over time.

-

Capitol and Initiative Led By:

Executive Vice President of Sales, previous Regional President of Automotive Aftermarket North America and EU IAM Sales, Enrico Manuele

Ex-Bosch Automotive Regional Vice President Sales North America, now Senior Vice President Sales, Doug Arnold

Ex-Bosch USA Vice President Automotive Aftermarket Sales Jarod Adams

Retired-Bosch Car Service Director North America, Technical Service Sales Workshop Concept Mark Polke

Ex-Bosch Car Service Director Digital Solutions, Workshop Concept & Shop-Ware affiliate Board, Jean Phillippe (JP) Persico

Luscious Garage Auto Repair shop owner, rebranded Earthling Automotive, shop-ware shop management system CEO (recently acquired by Vehlo), Carolyn Coquilette

*affiliates appliqué

Provisional Considerations:

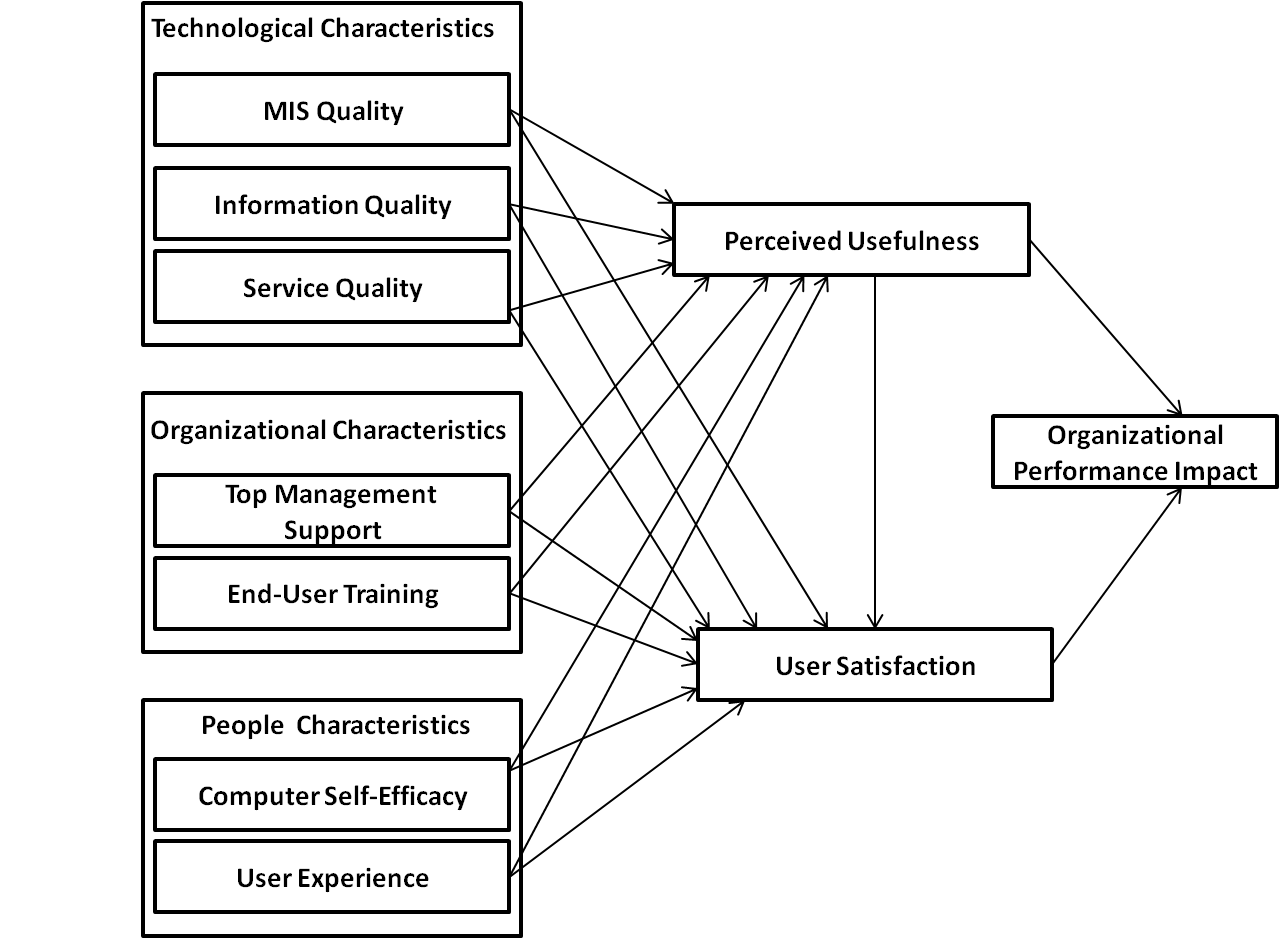

Figure 1: Optimal value considerations to be applied during product concept assessment & implementation stages. Ann was hired in to retest the constraints, product, attrition, and market viability and to see what and how our strategic business partner would work with and adjust with Bosch to deliver to our enterprise client base; and scale software solutions in support what some called our ‘Trojan Horse’ north star initiative. While the initiative was well underway half way through COVID, lack of market attrition was not a key factor due to the pandemic.

Basic supply and demand models explain how pricing and volume adjust based on product availability and market demand, knowing when to push and pull could be the most important decision to make or break your business channels.

Rightward shift in demand- Typically from hypothesis markers result in a higher equilibrium price and increased quantity along the existing supply curve; know your breaking point.

Strategic incentives- such as AC Robinar unit promotions, Bosch Power Tool giveaways, international trips, and hands-on workshops were evaluated to reduce adoption friction and address post-conversion challenges.

Identifying the tipping point between incentives and value is critical to avoiding high churn, escalating customer acquisition costs, poor ROI, and product–market misalignment.

Early recognition of these trade-offs could have mitigated downstream risks and accelerated sustainable adoption.

“Technology may have changed the world- but it has not changed human nature. To survive and prosper now requires only the same fortitude and common sense as it did 200 years ago.”

-John M. Templeton, and Alasdair Nairn. Engines That Move Markets: Technology Investing from Railroads to the Internet and Beyond. 2nd ed., Harriman House, 2000.

“The only reason that it is possible to share all these amazing ideas because of how diverse <we are> and what kind of experiences we’ve had in our prior lives and where we came from; and because of this diversity, only then, is it possible to have a constructive debate we have everyday. ”

-Harvard Business School

L.oS Logistic Operating System, a Bosch Mobility + aws, a strategic collaboration

-

2021

Context:

Bosch L.OS was developed as a global, cloud-native logistics platform designed to connect fragmented supply-chain systems into a horizontal integration layer enabling carriers, fleets, shippers, and software partners to access interoperable services and data-driven decision intelligence.

The global initiative was advanced through a strategic Bosch | AWS collaboration to modernize logistics and reduce operational inefficiencies at scale, using cloud-native foundations, service orchestration, and cross-partner data correlation empowered by ML and decision guidance.

Platform Vision & Early Build Phase:

The platform vision was in strategic motion early supported by an R&D and analysis efforts spanning progressive mobility innovation and project leads from San Francisco, Farmington Hills US offices partnering with Bosch EU and India and aws hyperscaler across the globe; where initial testing, architecture planning, and ecosystem positioning were underway while the venture was being “shopped” for the right stakeholder and investment structure.

The goal was to create a connected value-chain operating system that could bridge platform integrations in transportation management (TMS), warehouse (WMS), fleet (FMS)t, telematics, and related logistics services and providers into a unified platform experience—especially for operators historically underserved by enterprise tech.

-

Ann Cameron was brought in during the transition from platform initial concept to validation of strategic vision into commercialization readiness to help analyze market viability, shape GTM + partner strategy, and translate the concept into an operational model for North America acceleration. Ann championed cross-departmental business innovations, connecting central lines of service to enable cross-selling and deeper collaboration across our core platform.

As one of the first U.S.-based hires, she served as a central point for all inbound partner inquiries, pilot scoping, commercial modeling, and stakeholder alignment working across Bosch Mobility leadership, AWS ecosystem motions, and global teams to move the initiative toward scalable adoption.

-

AWS-native platform foundations with horizontal integration and service orchestration enabling cross-vendor data intelligence, partnering on ISV and partner co sell opportunities.

Open ecosystem strategy providing marketplace access for logistics services and partners, plus integration pathways for existing enterprise systems.

Multi-region operating structure spanning Europe, India, and the U.S., with stakeholder and investment evolution over time between interconnected Bosch global departments.

-

Mass market expansion signals: partner inquiries, pilot scoping velocity, engagement readiness, hired on growing operational team in marketing, digital platform sales and business.

Commercial viability development; partnering with Director/Head of Industry GTM Strategy to finalize pricing models, forecasting models, and competitive positioning across use cases.

Platform integration depth: Achieve TMS/WMS/FMS and partner API integration pathways, exploratory executive conversations and meetings to commercialization.

Connected value-chain coverage: end-to-end system interoperability across logistics operations, full value chain connection.

Data-to-decision maturity: Future focused on intelligence enabled connected data services partnering with global telematics players for cloud geo tracking and transparency.

-

The last two years have underscored a hard truth in logistics and supply chain: global disruption is no longer episodic- it’s structural.

Carriers and shippers face tightening margins, persistent labor constraints, volatile fuel and capacity dynamics, and rising customer expectations, while leadership teams simultaneously navigate AI acceleration with uneven internal readiness and a widening skills gap.

Ann’s advisory value in this environment is centered on helping C-suite and platform leaders move GenAI and AI/ML from ambition to operating reality, through lean, startup-speed execution inside complex enterprises. She supports organizations in:

Designing predictive and prescriptive decision systems powered by connected data foundations (not fragmented tools)

Restructuring teams for AI-enabled execution—clarifying ownership, reducing drag, and building operating cadence across product, engineering, and commercial functions

Building partner integration and ecosystem strategy across TMS/WMS/fleet platforms to unlock end-to-end value-chain interoperability

Commercial GTM modeling for platform scale—competitive analysis, pricing, forecasting, adoption loops, and competitive analysis to validate GTM pathways before expansion

Leadership enablement under disruption, translating complexity into executable decisions when millions are at stake and customer businesses are on the line

This is the work Ann continues to drive, turning connected supply chains into connected intelligence and improved business operations so leaders can operate leaner, decide faster, and scale with control in an AI-pressured global landscape.

#LikeABosch #mobility #engineering #iot #technology #engineering #sales #innovation #digitalmarketing

Partners & Success Stories

The More You Bosch, The More You Feel #LikeABosch

“The ability to think critically is an essential skill; can it be taught?

-Suzanne Cooper, Harvard Kennedy, Academic Dean for Teaching and Curriculum, Edith M. Stokey Senior Lecturer in Public Policy

“Operating at global scale, Bosch sits at the intersection of AI, mobility, and advanced engineering, powering connected automotive technologies and software innovations that redefine how the world moves. Time set aside for learnings.” -Ann Cameron

Learn about transportation players in industry:

Servant Leadership:

“The case method gives you humility. Your perspective is not enough to figure out the answer to a question. And actually, gives you the ability to ask other people what their perspective is.

I had a voice before <MBA>, and I think everyone comes in with a voice and perspective but it’s definitely shifting and growing and developing and hopefully maturing in a way to be more effective in <work> but leading people in real life.”

-Claire Branch, Harvard Business School